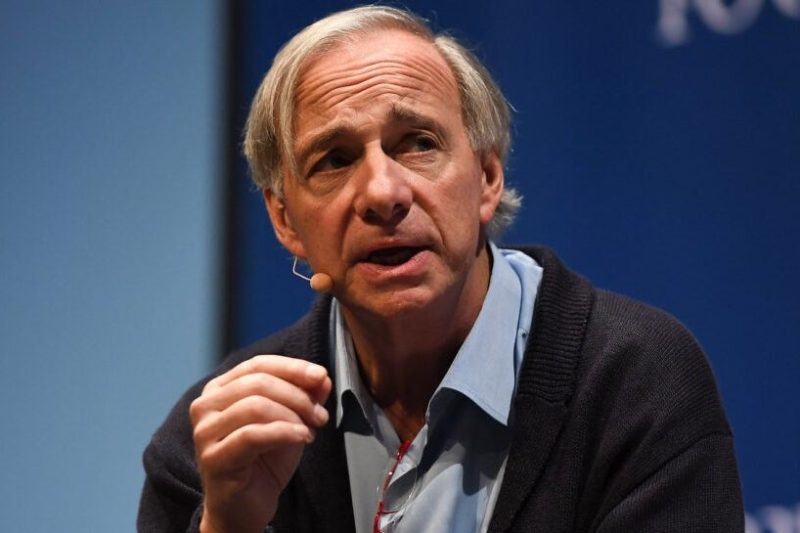

Legendary investor Ray Dalio, the founder of Bridgewater Associates, has once again sounded the alarm, this time warning of a potential recession fueled by the escalating US-China trade war. Despite a recent pause in reciprocal tariffs by President Trump, Dalio remains unconvinced that the underlying tensions have been sufficiently addressed. His concerns highlight the fragility of the global economy and the significant impact of geopolitical uncertainty.

Dalio’s prediction carries significant weight. He’s known for his accurate forecasting, notably his prescient warnings about the 2008 financial crisis. His current anxieties aren’t based on fleeting market fluctuations but rather a deeper analysis of macroeconomic trends and the potential domino effect of prolonged trade disputes. The ongoing trade war, characterized by tariffs and retaliatory measures, disrupts supply chains, increases prices for consumers, and dampens business investment – all factors that contribute to economic slowdown.

The pause in tariffs, while seemingly positive, may only be a temporary reprieve. The fundamental issues driving the conflict remain unresolved, leaving the potential for renewed escalation ever-present. This uncertainty creates a climate of fear and hesitation among businesses, making them less likely to invest and expand, further exacerbating the risk of recession.

While the full extent of the economic impact is yet to be seen, Dalio’s warning serves as a crucial reminder of the interconnectedness of the global economy. The US-China trade war is not an isolated incident; its consequences ripple across borders, affecting businesses and individuals worldwide. It underscores the need for careful consideration of the long-term ramifications of protectionist policies and the importance of finding diplomatic solutions to international trade disputes. The coming months will be critical in determining whether the pause in tariffs translates into a genuine de-escalation or simply a temporary lull before the storm.

Investors and policymakers alike would be wise to heed Dalio’s cautionary words and prepare for potential economic headwinds. The possibility of a recession, however remote, demands careful monitoring of economic indicators and proactive strategies to mitigate potential risks.