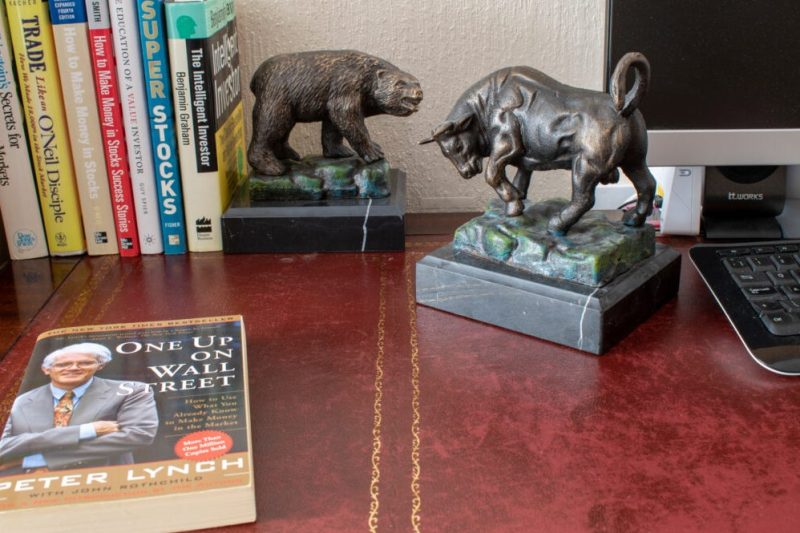

Legendary investor Peter Lynch’s journey to success wasn’t about perfectly predicting every market move. Instead, his philosophy revolved around a simple, yet powerful, concept: diversification and the potential for a few standout performers to dramatically boost overall returns.

Lynch often spoke about his early investing experiences, emphasizing the importance of owning a diverse portfolio. He understood that many stocks would perform modestly, some might even underperform. The key, he believed, wasn’t eliminating risk entirely, but rather strategically managing it through diversification. By spreading investments across various companies, the inevitable mediocre performers wouldn’t completely derail the overall portfolio’s performance.

The real magic, according to Lynch, lay in the potential for a small number of stocks to deliver extraordinary gains. He famously stated that if you own enough stocks, a few will inevitably ‘go up big time,’ generating substantial profits that can outweigh the underperformers. This isn’t about picking the next sure thing, but rather acknowledging the inherent unpredictability of the market and embracing the potential for unexpected windfalls.

This strategy isn’t about aggressive, high-risk bets. Instead, it highlights the power of long-term investing and the importance of patience. Lynch’s approach encourages investors to carefully research and select companies they believe in, understanding that some investments will yield modest returns, while others could potentially deliver life-changing gains. The key is to hold onto the winning stocks and allow their growth to compound over time.

Ultimately, Lynch’s wisdom underscores the importance of a well-diversified portfolio, a long-term perspective, and the acceptance that some investments will inevitably underperform. However, the potential for a few exceptional performers to significantly boost overall returns is a crucial element of his successful investment philosophy. It’s a reminder that even with careful planning and research, a degree of chance and unexpected growth always plays a role in achieving significant investment success.