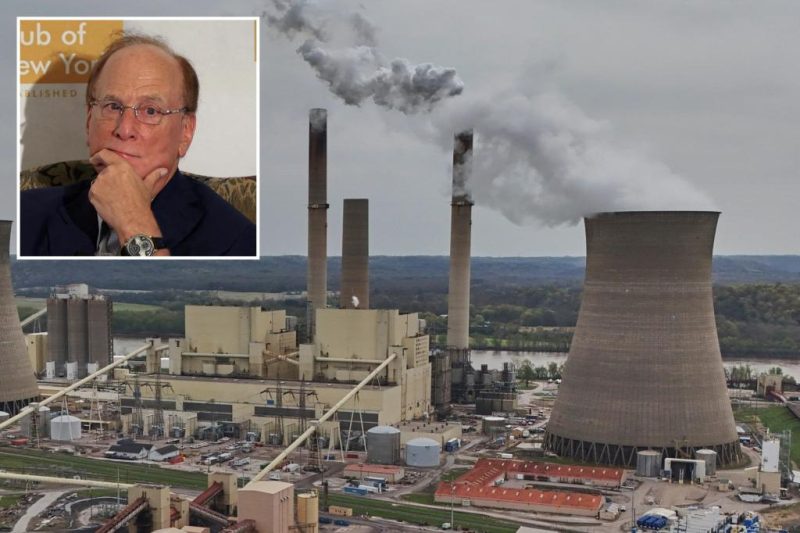

The US Justice Department and Federal Trade Commission (FTC) have thrown their weight behind Republican-led states in a significant antitrust lawsuit against major asset managers BlackRock, Vanguard, and State Street. This surprising move signals a potential major shift in the ongoing debate surrounding Environmental, Social, and Governance (ESG) investing and its impact on the energy sector.

The lawsuit, filed by Texas and twelve other states, alleges that the three asset management giants conspired to reduce coal production through their climate-focused investment strategies. The states argue that these actions constitute an anti-competitive practice, suppressing the coal industry and potentially driving up energy prices.

In a significant development, the DOJ and FTC filed a statement of interest supporting the core arguments of the Republican-led states. Their court brief explicitly stated that the alleged actions, including concerted efforts to lower coal output, violate long-standing antitrust laws. This effectively counters the asset managers’ claims that their investment strategies fall under an exemption for passive investors.

BlackRock, in response, maintains that divestment from coal would harm companies’ access to capital and lead to higher energy costs. State Street similarly defended its actions, asserting that their investment decisions are made in the best long-term interests of their investors. Vanguard also reiterated its commitment to investor returns.

This development marks a considerable political setback for BlackRock, Vanguard, and State Street. These firms, managing a combined $27 trillion in assets, have become a target for conservative Republicans who accuse them of prioritizing environmental and social concerns over maximizing returns for clients. This case highlights the growing tension between ESG investment principles and traditional antitrust concerns.

The case’s outcome will likely have significant implications for the future of ESG investing and the regulatory landscape surrounding asset management. US District Judge Jeremy Kernodle is set to hear arguments on the asset managers’ motion to dismiss the case in June, making this a pivotal moment in the legal battle.