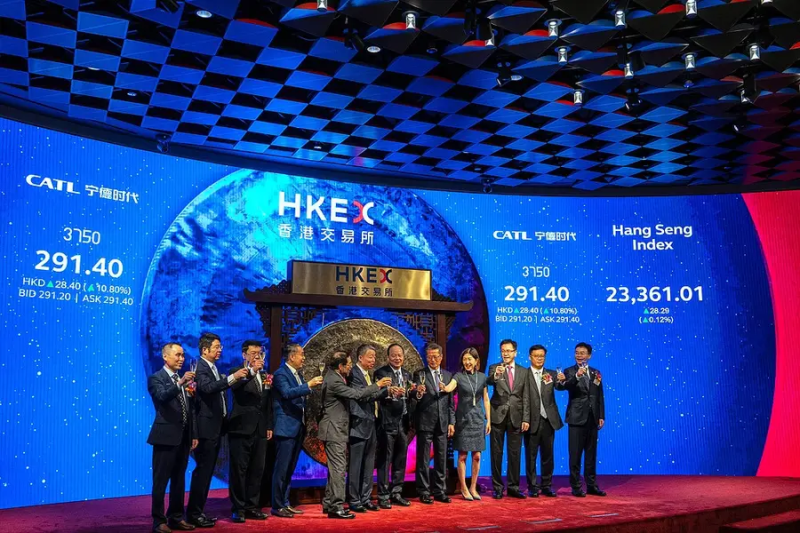

Hong Kong’s stock exchange experienced a phenomenal surge in initial public offerings (IPOs) during the first half of 2025, solidifying its position as a leading global financial center. A staggering 44 companies listed on the Hong Kong Stock Exchange, collectively raising a remarkable $13.6 billion. This impressive figure represents a significant portion of the global IPO market, accounting for a full quarter of all worldwide fundraising during the period.

This dramatic increase in Hong Kong IPO activity is largely attributed to a shift in the global landscape. Many Chinese companies, previously favoring listings on the New York Stock Exchange, are now increasingly choosing Hong Kong as their preferred destination. This change is driven by a confluence of factors, including escalating geopolitical tensions, regulatory uncertainty in the United States, and a desire for closer proximity to their primary investor base.

The influx of Chinese companies into the Hong Kong market has injected considerable vitality into the city’s financial ecosystem. This surge in IPO activity not only boosts the Hong Kong Stock Exchange’s profile but also stimulates economic growth and job creation within the financial sector and beyond. The increased trading volume and investor interest further contribute to a more dynamic and robust market.

While the reasons behind this exodus from New York are complex and multifaceted, the clear outcome is a significant strengthening of Hong Kong’s standing as a major global financial hub. The first half of 2025 serves as a powerful testament to Hong Kong’s resilience and adaptability in the face of evolving global dynamics, and it will be fascinating to observe whether this trend continues in the second half of the year and beyond.